In Germany, every citizen who starts working for the first time needs the German „Sozialversicherungsnummer“ (social security number). This applies as well to foreigners starting to work with a company. However, there may be some exceptions.

Let’s get started to learn the ABC of this formality. Once you’ve got your unique ID, it’s yours for a lifetime 👋.

This is the essence of what you need to know:

We have more than one identity number in Germany, which are for different purposes. That‘ s different from the USA, for example, where ONE social security number is tied to all parts of a person’s life. Germans think this is a bit scary, for data protection reasons we split it up. Nevertheless, when you start a job, you can’t do without this number.

What is this German Sozialversicherungsnummer?

The social security number is one of the most important identification numbers in the life of a professional working in Germany.

When you start a job as an employee and receive a salary, you need to have the number. Salary cannot be paid without the number.

The German public pension fund (Deutsche Rentenversicherung) uses the Sozialversicherungsnummer to identify you.

It’s a unique number, and it never changes.

Why do I need the Sozialversicherungsnummer?

You need the number when you start your first job in Germany.

Employers are instructed to ask to check the social security card or the corresponding letter at the beginning of employment. Your employer will ask you to submit it as soon as you’ve signed the employment contract.

This is because the employer will register you officially and start preparing the process of preparing the salary calculation and payroll – and the number is needed to do this. With this number, your employer can deduct the pension contributions from your salary.

Also, your number triggers the process of calculating other social security contributions like health insurance, long-term care, and unemployment insurance.

In case you want to leave Germany anytime later you need your number to retrieve your pension payments.

In case you find yourself unemployed, you need your Sozialversicherungsnummer to register at Agentur für Arbeit and apply for unemployment benefits.

Anybody who does NOT need this number?!

Now, while every German citizen needs the Sozialversicherungsnummer in working life it’s a bit different for (some) foreigners. Because German social insurance law does not apply to foreign employees by 100 percent!

There are a few exceptions. In case of a question, your health insurance will be able to help you.

You don’t need this German ID number if:

- you’ve been posted to Germany by your employer or

- you’re employed or self-employed in more than one country, or

- you are subject to an exceptional agreement with another state.

What is the composition of my number?

At that time, I gave a workshop for foreign fathers in Germany so that they could advise their teenagers on choosing a career. One of the gentlemen asked me why this number existed. At that time, I had a guest from the city administration with me, the head of the office from the city hall. She was able to explain all the details off the cuff – and because this was absolutely new to me, I don’t want to withhold them from you either.

Please, here’s the detailed explanation😏:

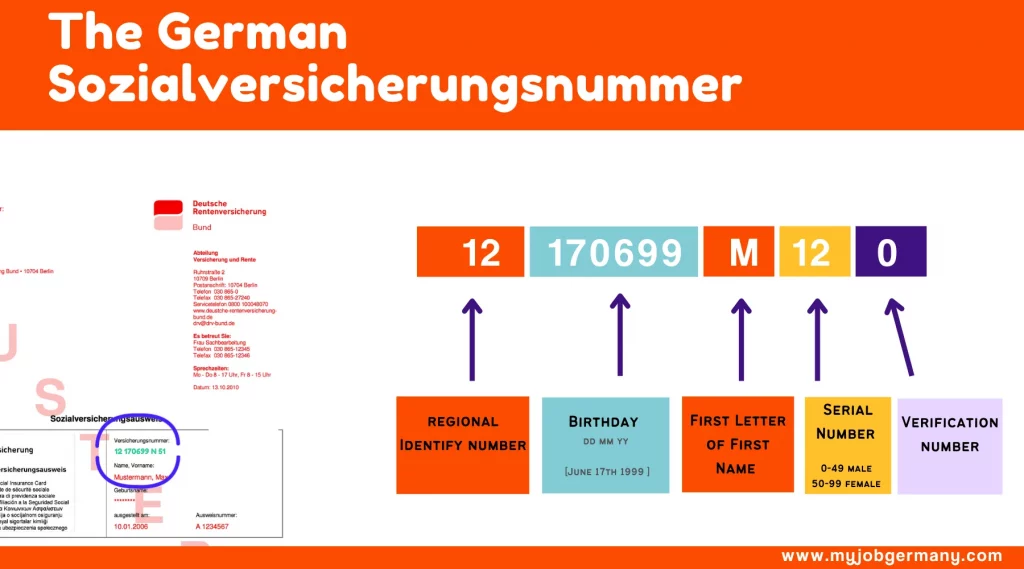

The social security number is composed of twelve different digits and letters, as you can see in the figure. Included are:

The date of birth in the format DDMMYY

the first letter of the birth name,

two digits for the serial number, which ranges from 00 to 49 for men and from 50 to 99 for women and proof code to differentiate you from people with same name and birth date.

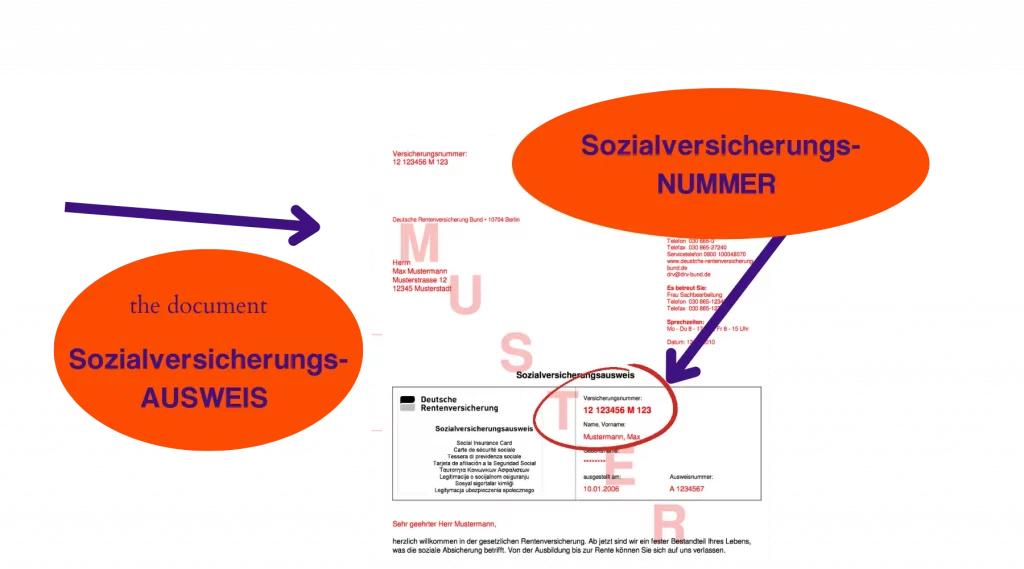

What exactly is the „Sozialversicherungsausweis“ or ID?

The identity card actually is the sheet of paper you receive with your number on it. I have to admit, that I’m sure that I have this identity card somwhere among my other stuff…. but for my profession it’s not a criticial document. For me it’s fine to have the number.

But when you start with your first job in Germany, it’s important. Also, in certain areas and professions, you’re required to carry your identity card, passport, passport substitute or identity card with you.

Obligation to carry the ID with you

In certain business areas, you need to present your identity card to the Customs Administration authorities upon request during inspections. These are mainly areas of work where undeclared work is more frequent. Here, checks by the customs administration authorities may be carried out without notice. If you’re working in these fields, your employer must provide proof and written notice of the obligation to carry and present identification documents:

- Construction industry

- meat industry,

- Catering and accommodation industry,

- Building cleaning industry,

- passenger transportation,

- prostitution,

- showmen’s trade,

- forwarding, transport and related logistics,

- forestry enterprises,

- companies involved in the construction and dismantling of trade fairs and exhibitions

Join my German Business Culture – Insights

Get the latest news, updates and releases.

Please check the data-privacy for further details about the newsletter.

How do I get my German Sozialversicherungsnummer?

You get it when you register /sign a contract at public health insurance

You get your Sozialversicherungsnummer after you apply for public health insurance. This is done automatically.

They’ll send you the number via Post on a sheet of paper to your German address. The sheet of paper is already your Sozialversicherungsausweis, please keep good care of it.

Your unique number is written on it.

Your new employer can request the number to be issued

Another option is for your employer to contact the health insurance company and request that they issue your social security number for you. For this purpose, your employer will pass on your personal data, which will be linked to your ID:

- Name

- Name at birth, if this differs from the surname

- Place of birth

- Date of birth

- Sex (key)

- Nationality (key)

The health insurance coordinates to have the number issued and sends it to your employer.

That’s convenient, but it may take some time. I’ve heard it can take easily up to six weeks, even though I don’t know why.To speed things up, it’s easier to make sure you get it directly after signing in with a public health insurance.

You already have a public health insurance?

Ask your health insurance company for your Sozialversicherungsausweis (social security card) or a Mitgliederbescheinigung (membership certificate) – both contain your social security number.

If you go in person, they will issue it right away.

If you prefer to do it online, they will send it via post to your German address. The online forms are in German language, it’s free of charge:

Request your Sozialversicherungsnummer with Techniker Krankenkasse

Request your Sozialversicherungsnummer with DAK

Where you can also find your social security number

If you’re already working, you’ll find your number on every monthly pay statement.

And in case of doubt, your HR department will always help you. They keep your number on file to make the payroll and deduct social security contributions. When you quit your job, HR may keep a copy of your Sozialversicherungsausweis but has to return the original Sozialversicherungsausweis (just in case you forgot to take it when you started your job. Better keep it always in your own files).

🦉 Wrap up

Now, you’ve come to realize that there are only a few things to know. Just make sure you get it without delay and submit it to your employer.

Keep the number and the card safe, you’ll need it again and again.

Best of luck in your job!

Schreiben Sie einen Kommentar